Today’s context makes the application of technology to financial inclusion relevant because it paves the way for inclusive growth by assisting the downtrodden segments of society.

Importance;

- Financial inclusion is defined as the provision of practical and reasonably priced financial goods and services, such as payments, transactions, savings, credit, and insurance, to both individuals and businesses in a sustainable and morally upstanding manner.

- Social mobility is made possible through financial inclusion, which is crucial since it promotes it. These tools support communities and empower people, which can benefit in fostering economic progress.

- Additional financial services: Account holders are also more likely to use credit and insurance to start and grow businesses, put money into their own or their children’s health or education, manage risk, and bounce back from financial setbacks, all of which can improve their overall quality of life.

Challenges;

- Inactive bank accounts: Almost 80% of Indians have a bank account, yet nearly 18% (81.38 million) of those accounts are inactive and have “zero balances.” Additionally, up to 38% of accounts are inactive, meaning there haven’t been any deposits or withdrawals in the last year, showing that many Indians are still not completely incorporated into the formal banking system.

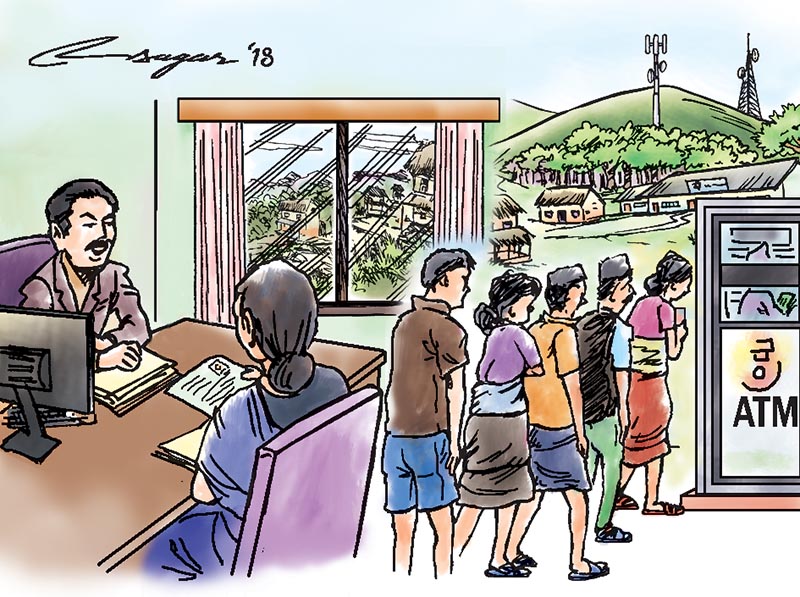

- Poor communications infrastructure: India still lacks a reliable broadband internet connection and a strong communications infrastructure. Although technology has advanced at ever-increasing rates, the gap has grown wider due to the country as a whole’s incapacity to adopt new breakthroughs.

- More than 310 million people in India require a basic cell phone, making it difficult for the country to connect its residents to the internet. Due to this, account holders are unable to get important information, such as specifics on account transactions.

- Increasing reliance on local agents: Financial institutions must also be more eager to convey signals for small-scale transactions. These elements have caused a growing reliance for local agents.

Correlation between Technology, Digital division and Financial inclusion

- The digital divide between urban and rural areas, which predominate in India, is clear. Only 14.9 percent of rural homes have internet connectivity, compared to 42 percent of families in metropolitan areas, and only 4.4 rural families have computers, compared to 14.4 percent of urban households. In contrast to metropolitan areas, where internet connectivity is available to 37 percent of adults, just 13 percent of adults live in rural areas.

- Rural areas with high interest rates: Particularly, such gaps are linked to many financial aspects, starting with small-time lenders charging high interest rates, which are typical in rural areas. Problems with credit access still exist. More rural locations have not yet been reached by government programmes that would effectively increase credit availability.

- Lack of knowledge about online loans: People discover that there should be more possibilities for online loans from reputable financial institutions or digital lending. Additionally, due to complex banking procedures like requiring identity documents and keeping a certain balance in an account, rural clients need assistance accessing potential financial services.

- Limited access to computer and communication technologies is another factor contributing to the digital divide. Fewer people in India can afford the equipment required to access digital information.

- A single national strategy is challenging since people in different parts of India speak distinct mother tongues, adding to the difficulty of delivering diverse content. Additionally, there are too many state-to-state differences in the proportion of people who have access to computers or who are proficient enough to use the internet. Therefore, a general strategy cannot be used across the board.

- Financial illiteracy prevents Indian citizens from maximizing technological interventions. Adult illiteracy rates are about 266 million. Financial inclusion has been significantly hampered by the lack of financial literacy, and many financial cybercrimes have increased in tandem with rural residents’ growing mistrust of technology. As a result, adoption rates have been lower than expected while cybercrime rates have increased by 6% in the same year.

- Data privacy issues: Because Personal Identifiable Information (PII) guidelines are not strictly enforced and followed, a lot of data is easily accessible to many different parties, which raises serious data privacy issues.

@the-end

Every aspect of life is impacted by the digital divide, including literacy, wellbeing, mobility, security, and access to financial services, among other things. Therefore, the emphasis must shift from straightforward economic growth to equitable and inclusive growth for a rapidly developing country like India.