The Centre is in the final stages of notifying an Emissions Trading Scheme following the passage of the Energy Conservation (Amendment) Bill last December (ETS).

Emissions Trading Scheme (ETS)

- India currently lacks a national Emissions Trading Scheme (ETS). However, there have been some efforts in the country to implement an ETS.

- The Ministry of Environment, Forests, and Climate Change (MoEFCC) published a draught of the National Clean Air Programme in 2018. (NCAP).

- For the first time, it proposed the implementation of a market-based mechanism to reduce air pollution.

- The mechanism was not explicitly referred to as an ETS, but rather as a “cap-and-trade system.”

Successful example of Carbon Market: EU’s emissions trading system (ETS)

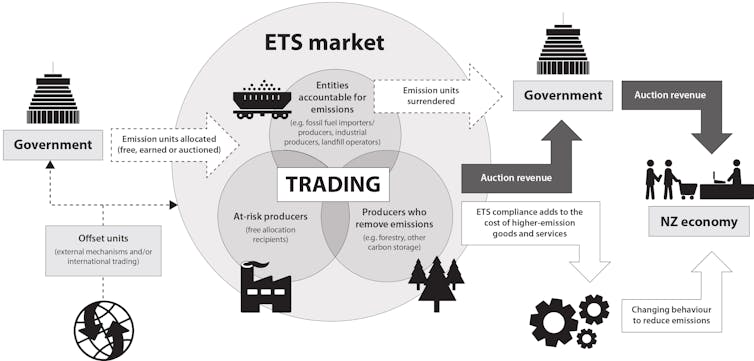

- Member countries set a cap or limit for emissions in various sectors such as power, oil, manufacturing, agriculture, and waste management under the EU’s ETS, which was launched in 2005.

- This cap is set based on countries’ climate targets and is gradually reduced to reduce emissions.

- Governments issue annual allowances or permits to entities in this sector in proportion to the emissions they can generate.

- If a company’s emissions exceed the capped amount, it must purchase additional permits, either through official auctions or from other companies.

- This is the ‘trade’ component of cap-and-trade.

How is the price of carbon determined?

- The term “carbon footprint” refers to the amount of carbon emitted by the environment.

- Notably, businesses can save excess permits for later use.

- Companies can use carbon trading to determine whether it is more cost-effective to use clean energy technologies or to purchase additional allowances.

- These markets may encourage energy conservation and the use of cleaner fuels.

Other similar examples

- In 2021, China launched the world’s largest ETS, which is expected to cover roughly one-seventh of global carbon emissions from fossil fuel combustion.

- North America, Australia, Japan, South Korea, Switzerland, and New Zealand all have active or developing markets.

The Importance of the Carbon Market

- According to the World Bank, trading in carbon credits could cut the cost of implementing NDCs by more than half — up to $250 billion by 2030.

- Global markets for tradable carbon allowances or permits increased by 164% last year to a record 760 billion euros ($851 billion).

- The EU’s ETS was the most important contributor to this increase, accounting for 90% of the total value of 683 billion euros.

- Voluntary carbon markets have a comparatively lower current global value of $2 billion.

What is the status of the UN?

- The UN international carbon market envisioned in Article 6 of the Paris Agreement has yet to begin because multilateral discussions about how the inter-country carbon market will function are still ongoing.

- Countries would be able to offset their emissions under the proposed market by purchasing credits generated by greenhouse gas-reduction projects in other countries.

- Previously, developing countries, particularly India, China, and Brazil, benefited significantly from a similar carbon market under the Kyoto Protocol’s Clean Development Mechanism (CDM) in 1997.

- India has registered 1,703 CDM projects, the second most in the world.

- But with the 2015 Paris Agreement, the global scenario changed as even developing countries had to set emission reduction targets.

The efforts of India

- The new Bill gives the Centre the authority to design a carbon credit trading scheme.

- Credit certificates are issued: The central government or an authorised agency will issue carbon credit certificates under the Bill to companies or individuals who have registered and are in compliance with the scheme.

- Carbon credits that can be traded: These carbon credit certificates will be tradable. Other people would be able to purchase carbon credit certificates on a purely voluntary basis.

Existing mechanisms

- Notably, two types of tradeable certificates are already available in India: Renewable Energy Certificates (RECs) and Energy Savings Certificates (ESCs) (ESCs)

- These are issued when businesses use renewable energy or save energy, both of which reduce carbon emissions.

Bill’s omissions

- There is no clear mechanism: The Bill does not specify the mechanism for trading carbon credit certificates, whether it will be similar to cap-and-trade schemes or another method, or who will regulate such trading.

- Confusion over nodal agency: While carbon market schemes in other jurisdictions such as the United States and the United Kingdom are framed by their environment ministries, the Indian Bill was tabled by the power ministry rather than the MoEFCC.

- Ambiguity regarding existing certificates: The Bill does not specify whether existing certificates would be interchangeable with carbon credit certificates and tradeable for reducing carbon emissions.

- Overlap: The question is thus whether all of these certificates can be exchanged with one another. There is some concern that overlapping schemes will dilute the overall impact of carbon trading.

Carbon market challenges

- There is a double counting of greenhouse gas reductions.

- Quality and authenticity are two characteristics of climate projects that generate credits due to a lack of market transparency.

- Greenwashing occurs when companies purchase credits to offset their carbon footprints rather than reducing their overall emissions or investing in clean technologies.

- Inefficiency: According to the IMF, including high-emitting sectors in trading schemes to offset their emissions by purchasing allowances may significantly increase net emissions.

Way ahead

- Alignment with NDCs: According to the UNDP, for carbon markets to be successful, emission reductions and removals must be genuine and consistent with the country’s NDCs.

- It states that “transparency in the institutional and financial infrastructure for carbon market transactions” is required.

Source: https://www.thehindu.com/news/national/centre-in-final-stages-of-notifying-emissions-trading-scheme/article66532660.ece