Skip to the content

- In the last five fiscal years, banks have written off bad loans totaling 10,09,511 crore, the finance minister told Parliament.

- In essence, writing off a loan means that it will no longer be considered an asset.

- A bank can lower the amount of non-performing assets (NPAs) on its records by writing down loans.

- The NPA loan is removed from the assets side by the bank, who then records the amount as a loss.

- The fact that the sum has been written off lowers the bank’s tax obligation is an additional benefit.

- Banks have wiped off loans using funds from depositors.

Why do banks resort to write-offs?

- Recovery problems: There is very little likelihood of recovery when the borrower has defaulted on the loan repayment, thus the bank writes off the loan. Loans that have been written off have very little possibility of being recovered, nevertheless.

- Provisioning: Following the write-off, banks are expected to pursue further avenues for loan recovery. They also need to make provisions.

- Reduce tax liability: As the profit is lowered by the amount of the written-off expenses, the tax liability will also decrease.

Who is at the forefront of write-offs?

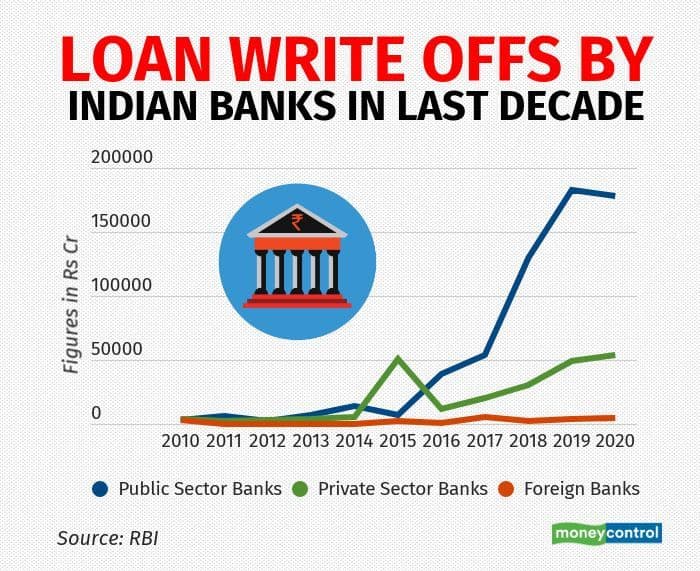

- Public sector banks recorded the majority of write-offs, accounting for Rs 734,738 crore (72.78% of the total).

- In the last five years, State Bank of India has had a drop in NPAs of Rs 204,486 crore among public sector banks as a whole.

- In the last five years, ICICI Bank reduced their NPAs by Rs 50,514 crore, the most amount among private banks.

- According to the RBI, during that time Axis Bank wiped off Rs 49,715 crore and HDFC Bank Rs 34,782 crore.

Recovery of such loans

- Since the loan account is not written off, neither the lender nor the bank is giving up the right to get their money back.

- The bank or lender may attempt to sue the loan defaulter for the amount owed.