The Chinese government’s 5% growth target for 2023 has disappointed observers, as it is lower than last year’s target and lower than India’s expected GDP growth in 2023. This is especially surprising given that India is benefiting from the positive impact of the country reopening following COVID-19 lockdowns, whereas China should benefit from its reopening only this year.

What are the reasons for China’s lower growth target?

- Risk of missing the growth target once more: The Chinese government does not want to risk missing its growth target again, as it did in 2022.

- Weak external demand and concerns about private investment: Even though consumption is improving, external demand remains weak, and it is difficult to predict whether private investment will increase given concerns about the role of the private sector in the Chinese economy, as well as the increasingly cautious sentiment expressed by foreign investors.

- Real estate sector continues to stifle growth: The real estate sector continues to stifle growth.

Growth that is sustainable

- The Chinese government recognises that excessive growth is no longer desirable because it exacerbates financial imbalances.

- Instead, they advocate for sustainable growth, which entails a structural shift in the Chinese economy as well as the implementation of stricter regulatory measures to contain financial risks and achieve more social goals such as a green economy and food security.

Foreign investment and job creation

- China emphasises the importance of job security as a goal of long-term growth, with the Chinese government setting a higher target for new jobs.

- Given the country’s concern about the job market, particularly among young workers, China’s recent charm offensive to retain foreign direct investment in China is an important source of job creation.

- Investors, on the other hand, are looking for greener pastures, with India likely to be a major beneficiary. Foreign investors are beginning to make a greater contribution to job creation in India, which may pose challenges for China as it attempts to retain foreign direct investment within the country.

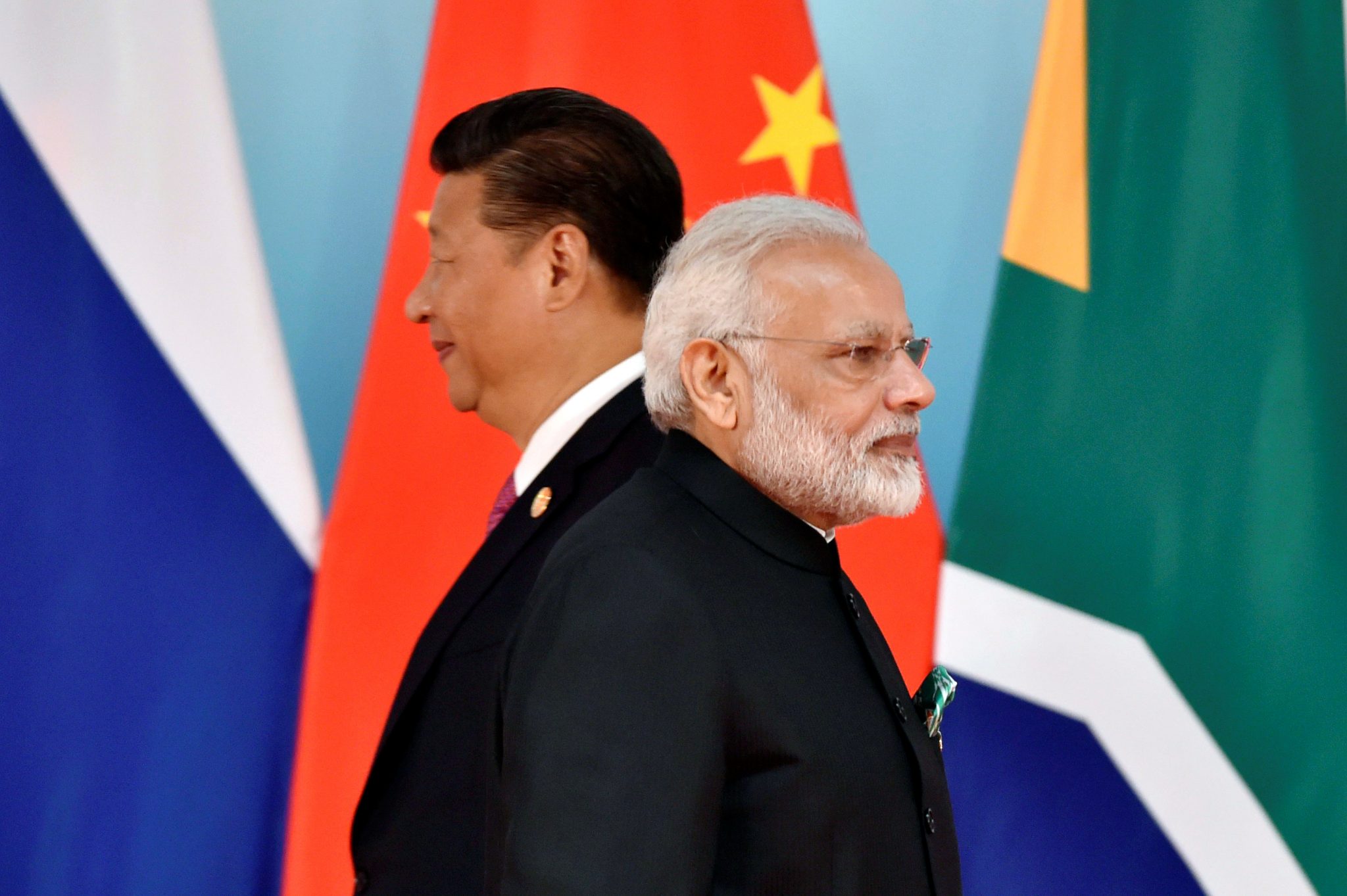

Growth prospects in India and China are compared

- India and China’s growth prospects, with a focus on job creation and competition for foreign direct investment.

- While India and China are similar in size and population, their growth prospects differ significantly.

- The Chinese government’s cautious growth targets are consistent with the Chinese economy’s current challenges, but they face more competition than before, particularly from India, which has a larger market size and labour pool.

- This pattern of resilient Indian growth and cautious Chinese growth targets will accelerate in the coming years, especially if the reshuffling of the value chain continues, pushed by geopolitics and high Chinese costs.

@the end

The Chinese economy may be experiencing structural deceleration, while India benefits from its demographic dividend. China’s structural slowdown and tighter regulatory measures may also have an impact on its future growth prospects. As a result, India may be better positioned than China for long-term growth in the coming years.

Source: https://www.worldbank.org/en/news/press-release/2022/12/05/india-better-positioned-to-navigate-global-headwinds-than-other-major-emerging-economies-new-world-bank-report