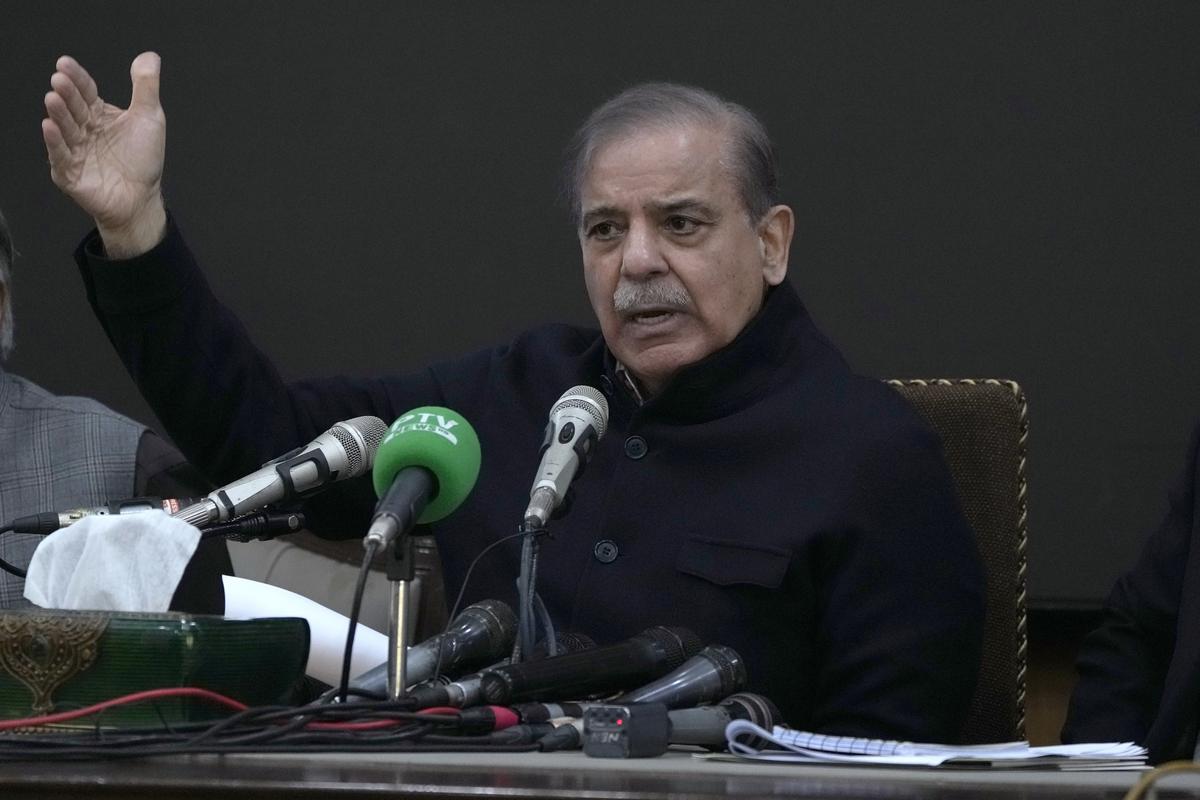

- During a recent review of Pakistan’s debt, India emphasised the necessity for tight supervision as new Prime Minister Shehbaz Sharif sought more budgetary help from the IMF.

Background:

- India has taken a harsh line, calling for “stringent monitoring” of any emergency funds supplied by the International Monetary Fund (IMF) to Pakistan, emphasising that such monies must not be redeployed to pay defence expenses or repay loans from other nations.

- India’s viewpoint was communicated to the IMF’s executive board at a recent assessment of the Fund’s continuing $3 billion short-term Stand-By Arrangement (SBA) with Pakistan.

About the International Monetary Fund (IMF):

- The IMF strives to achieve long-term growth and prosperity for all of its 190 member countries.

- It accomplishes this by promoting economic policies that encourage financial stability and monetary cooperation, which are critical for increasing productivity, job creation, and economic well-being.

- The IMF is run by and responsible to its member countries.

Aims and objectives include

- Strengthening international monetary cooperation, promoting trade and economic progress, and discouraging measures that hurt prosperity.

Functions of IMF:

- The IMF provides policy advice at global and regional levels, identifying potential risks and recommending policy modifications to support economic growth and financial stability.

- Financial Advice: The IMF provides financial assistance to crisis-affected nations to allow them to pursue policies that restore economic stability and prosperity. It also offers preventive finance to assist prevent crises. IMF assistance is constantly adjusted to fit countries’ changing needs. Crisises can be caused by either domestic or external factors.

- Domestic factors include ineffective fiscal and monetary policies, which can result in large current account and fiscal deficits and high levels of public debt; an exchange rate that is fixed at an inappropriate level, eroding competitiveness and resulting in the loss of official reserves; and a weak financial system. Political instability and inadequate institutions can also cause crises.

- External variables include shocks such as natural disasters and big fluctuations in commodities prices. With globalisation, rapid shifts in market sentiment can cause money flow volatility. Both are common causes of crisis, particularly in low-income countries.

Significance of IMF monitoring:

- Crucial for recognising potential risks and making necessary policy adjustments.

- International cooperation on these endeavours is crucial in today’s globalised economy, as one country’s problems or policies can have far-reaching consequences.

- Individual countries are monitored bilaterally, while the global economy is monitored multilaterally.

Conclusion

Uncertainty about Pakistan’s capacity to promptly negotiate a new IMF programme when the current one expires in April 2024 remains considerable. Pakistan’s government liquidity and external vulnerability concerns will remain extremely high unless there is clarity on a credible longer-term funding plan

Source: https://www.thehindu.com/news/national/india-to-imf-ensure-pakistan-does-not-divert-loans-to-foot-its-defence-third-country-debt-bills/article67921899.ece#:~:text=Taking%20a%20tough%20stance%2C%20India,of%20loans%20from%20other%20countries.